Why Now Is a Great Time To Sell Your House

As we near the end of the year, more homeowners are realizing the benefits of today’s sellers’ market. Record-breaking home price appreciation, growing equity, low inventory, and competitive mortgage rates are motivating homeowners to make a move that addresses their changing lifestyles.

In fact, recent data from realtor.com shows a larger share of homeowners are planning to list their houses this winter. So, that means more homes are about to hit the market, which will lead to more choices for buyers too.

According to George Ratiu, Manager of Economic Research at realtor.com:

“The pandemic has delayed plans for many Americans, and homeowners looking to move on to the next stage of life are no exception. Recent survey data suggests the majority of prospective sellers are actively preparing to enter the market this winter.”

If you’re thinking of waiting until the spring to sell your house, know that your neighbors may be one step ahead of you by selling this winter. If you want to stand out from the crowd, this holiday season is the best time to make sure your house is available for buyers. Here’s why.

Sellers Are Still Firmly in the Driver’s Seat

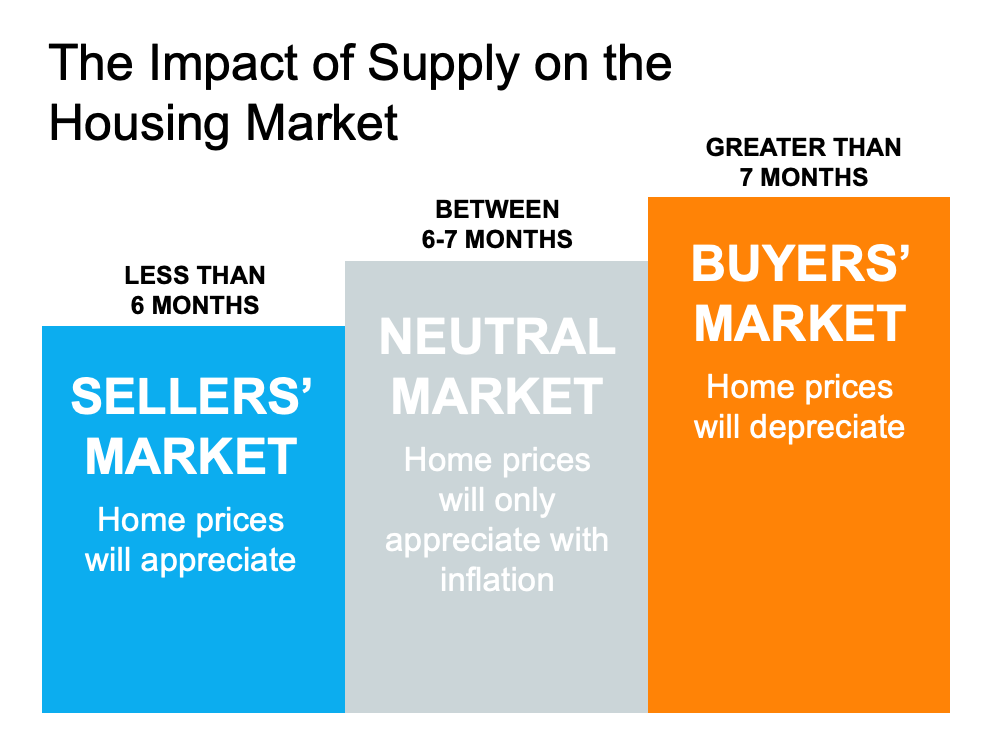

Historically, a 6-month supply of homes for sale is needed for a normal or neutral market. That level ensures there are enough homes available for active buyers (see graph below): The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows the inventory of houses for sale sits at a 2.4-month supply. This is well below a neutral market.

The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows the inventory of houses for sale sits at a 2.4-month supply. This is well below a neutral market.

What Does That Mean for You?

When the supply of homes for sale is as low as it is today, it’s much harder for buyers to find homes to purchase. This drives up competition among buyers, who then submit increasingly competitive offers to win out against others in the home search process. As this happens, prices rise and your leverage as a seller rises too, putting you in the best position to negotiate a contract that meets your ideal terms.

And while the low housing supply we’re facing won’t be solved overnight, sellers this season should move quickly to maximize their potential. As the data shows, with more prospective sellers planning to list their homes this winter, selling sooner rather than later helps your house rise to the top of a holiday buyer’s wish list so you can close the best possible deal.

Bottom Line

Listing your home over the next few weeks gives you the best chance to be in front of buyers competing for homes this holiday season. Let’s connect today to discuss how you can benefit from today’s sellers’ market.

![Reasons To Hire a Real Estate Professional [INFOGRAPHIC] | Simplifying The Market](https://www.sellingthe608.com/wp-content/uploads/2021/11/20211126-MEM.png)