Turning a House Into a Home: The Benefits You Can Actually Feel

There’s a lot of conversation about home prices, mortgage rates, and affordability right now – and those things are important. But if you’re thinking about buying a home, it’s worth remembering something the headlines rarely talk about: people don’t buy homes just for financial reasons. They buy them for their lives.

Because while homeownership can absolutely be a smart long-term financial move, it also comes with some emotional benefits spreadsheets just can’t capture. Maybe that’s why a 2025 survey from Fannie Mae notes:

“Consumers were twice as likely to mention lifestyle benefits (67%)—like security, customization, and outdoor space—than financial benefits (34%) when explaining why their homes have become more important in recent years.”

Here are a few reminders of what owning a home gives you that renting never will.

1. A Milestone You Get To Be Proud Of

Buying a home is a big deal. First home, fifth home – it doesn’t matter. It’s a moment you’ll remember. And when you finally get those keys and walk through the door, that feeling of “I did this” hits different. It’s not just a purchase. It’s an accomplishment.

2. A Place That Feels Like Your Reset Button

Life is busy. Having a place that’s truly yours where you can shut the door, take a breath, and settle into your own routine is something renters rarely talk about until they finally experience it. Home becomes the place you go to recharge, not just the place your mail is delivered.

3. Space That Fits the Way You Actually Live

Need a quiet corner for work calls? A backyard big enough for the dog that thinks it’s a person? A shorter drive to see the people who are most important to you? When you own, you get to choose a space that fits your life now and where it’s heading – and it just feels right.

4. Freedom To Make It 100% Yours

Want to paint the kitchen navy? Go for it. Thinking about a wall of floating shelves or a bold wallpaper moment? Do it. Need space for a home gym or a reading nook? Make it happen. Homeownership gives you the freedom to shape your space instead of asking for permission to change it.

Bottom Line

Buying a home isn’t only about dollars and data points – it’s about building a life you love.

So, if you’re thinking about a move in 2026, keep the emotional side in the conversation too. And when you’re ready to explore your options, reach out to a trusted local agent who can guide you through the process with clarity and confidence.

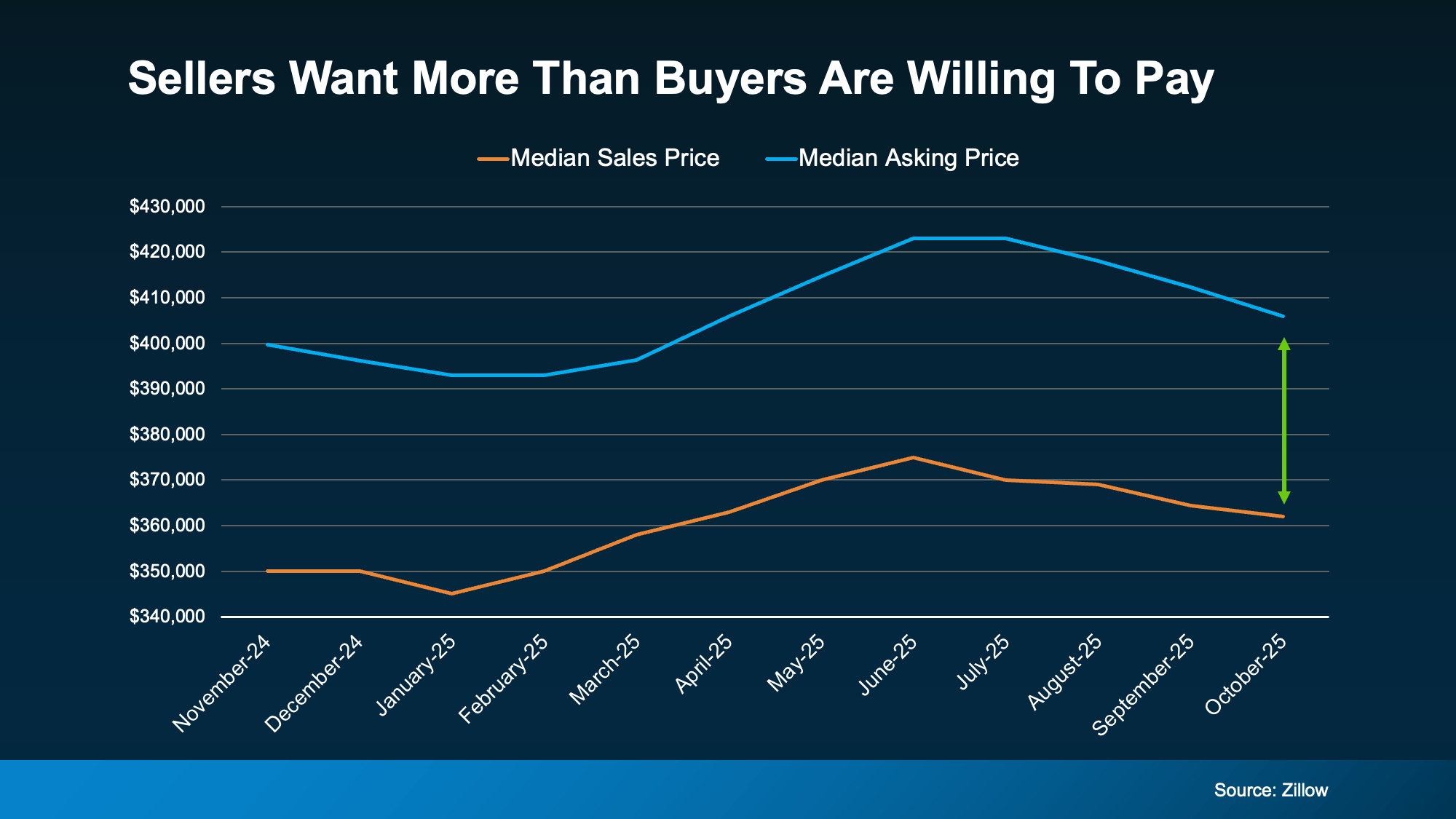

The Fix: Get a fresh pricing analysis rooted in what’s happening right now in your neighborhood – not what happened in 2021. Sometimes even a small adjustment can bring the right buyers through the door. HousingWire reports many successful sellers only had to reduce their price by about 4% to get real traction. In the grand scheme of selling a home, it’s really not that much.

The Fix: Get a fresh pricing analysis rooted in what’s happening right now in your neighborhood – not what happened in 2021. Sometimes even a small adjustment can bring the right buyers through the door. HousingWire reports many successful sellers only had to reduce their price by about 4% to get real traction. In the grand scheme of selling a home, it’s really not that much. 4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate