This May Be the Best Time To Buy a Brand-New Home

New home construction today is giving buyers something it feels like they haven’t gotten much lately: a real shot at both the home they want and the deal they need. More brand-new options are on the market right now, and builders are rolling out incentives that make these homes more affordable than many people expect.

It’s a combination that doesn’t come around often – and it’s putting buyers in a surprisingly strong position this season. Here’s why this moment matters and why it’s worth partnering with your own local agent to take advantage of it.

1. More New Homes Are Available Now – and That May Not Last

There’s more new construction on the market today than normal. And for buyers, that means:

- More cutting-edge communities

- More move-in-ready homes

- More floor plans to pick from

- More upgraded designs and modern features

But that variety may not last.

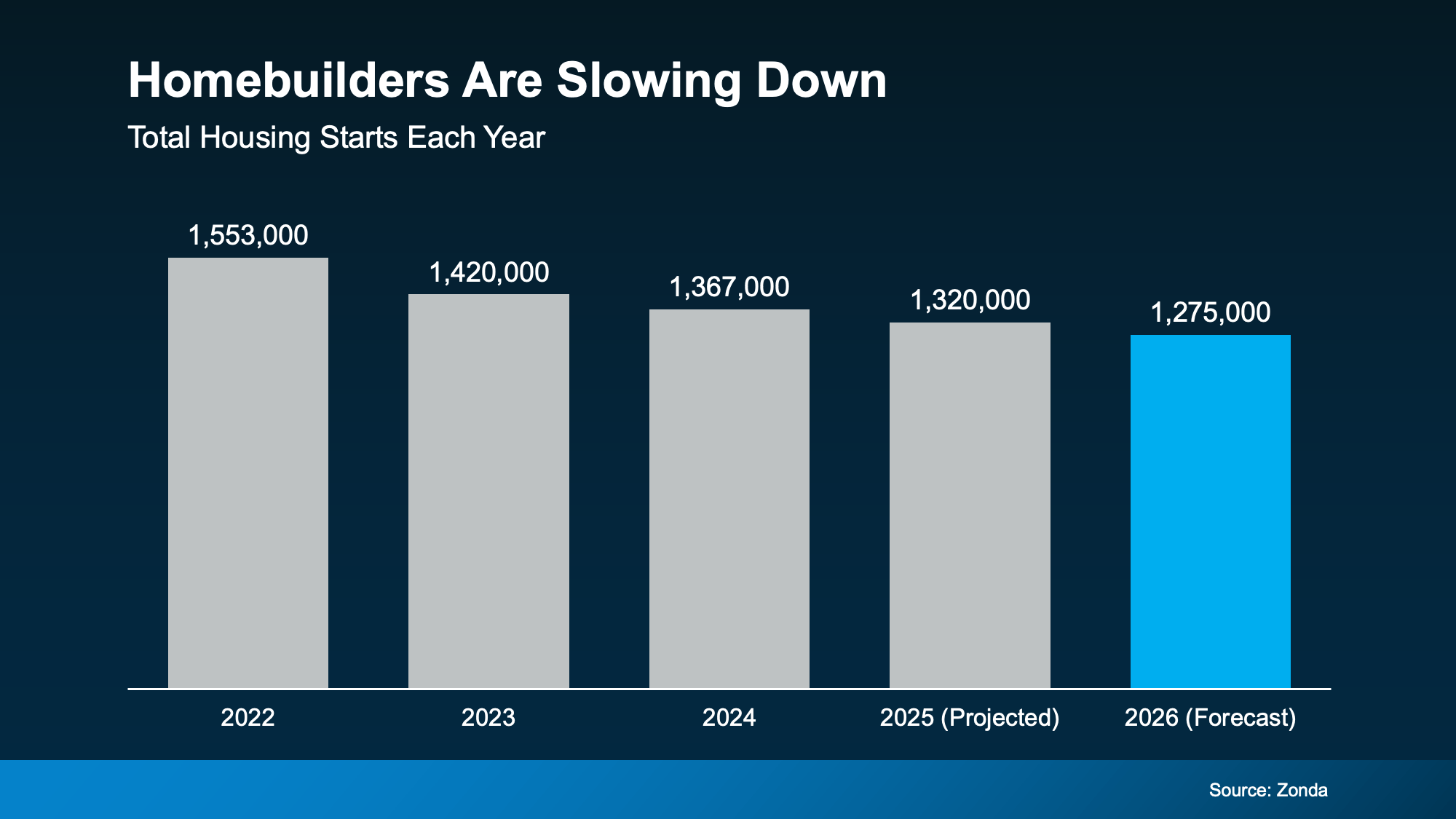

Data from Zonda shows that even though it feels like new homes are popping up just about everywhere, builders have actually started pulling back. The number of starts (that’s when builders break ground) has been slowly but steadily declining over the past few years. And that’s good because it prevents overbuilding nationally.

But here’s the real insight that can give you an edge. Forecasts show that slight downward trend should continue next year (see graph below):

It’s a signal that the new inventory we have now may be your widest pool of all-new options for a while.

It’s a signal that the new inventory we have now may be your widest pool of all-new options for a while.

Today, Redfin says roughly 1 in 3 homes (27%) on the market are new builds. That’s higher than the norm, but the lowest share in four years. And it makes sense based on the graph above.

That means if you want more options to choose from, now’s the time to look.

And if you’re wondering: why the pullback? It’s simple. Since there are already more new homes for sale than usual, builders want to focus on selling down the supply they already have on the market rather than adding more new homes. And that leads to point two.

2. Builder Incentives Just Hit an All-Time High

Here’s where things get even better for buyers. To make sure the inventory they have now keeps moving, builders are offering incentives at levels not seen in years – and many of those perks directly help buyers with affordability. Buyers today are getting:

- Lower Prices: Builders are dropping the prices on their brand-new homes to draw in buyers.

- Help with Closing Costs: Some builders are covering thousands of dollars in fees to reduce the upfront cost of buying.

- Extra Upgrades: Think premium finishes, appliance packages, and designer features, all added at no extra cost.

- Mortgage Rate Buydowns: This is when the builder pays to get you a lower mortgage rate, which reduces your monthly payments and helps with affordability.

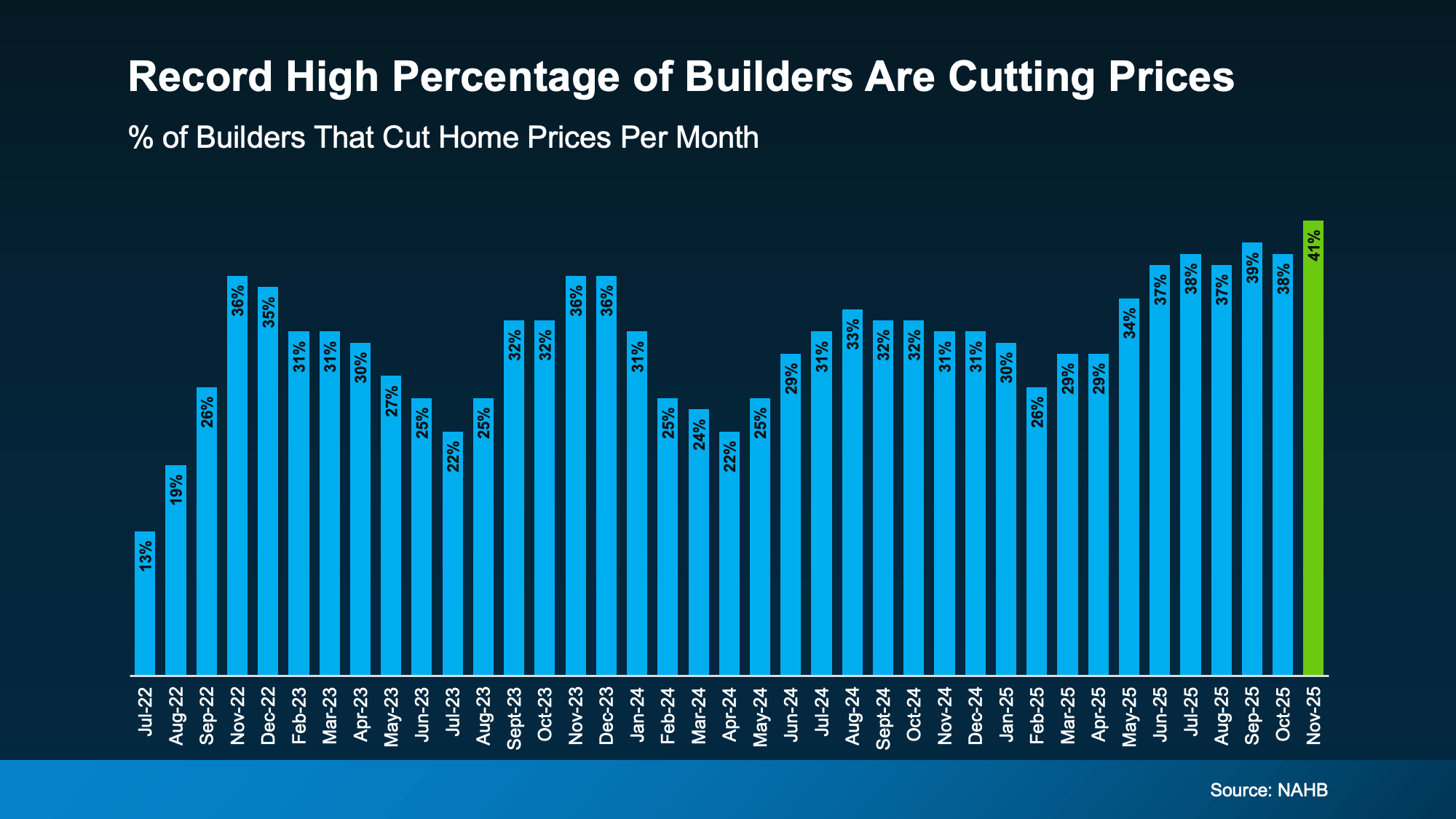

But you don’t have to be lucky to see these types of perks. The truth is, the vast majority of builders are offering advantages like these right now. According to the National Association of Homebuilders (NAHB) 65% of builders say they’re using some type of sales incentive and:

“. . . 41% of builders reported cutting prices in November, a record high in the post-Covid period and the first time this measure has passed 40%.”

That’s a big deal. It shows how willing builders are to negotiate right now.

That’s a big deal. It shows how willing builders are to negotiate right now.

And if you look closely at the graph, you’ll notice the use of incentives typically falls in the early part of the year, as buyer demand rises going into the spring. So, you have an edge if you act now. This may be your ideal window to find the most options and better prices.

If you lean on your own agent and you’re savvy about what you ask for, you could walk away with some of the best perks buyers have seen in years. And when every dollar counts and any incentive helps your bottom line, that’s worth looking into.

More options and more savings = an offer too good to pass up.

Bottom Line

With most builders offering generous incentives and a wider selection of new homes for sale, buyers may be looking at one of the best times in years to buy a new build.

Connect with a local agent if you want to know which communities, builders, and incentives offer the most value today. Having your own agent (not the builder’s representative) makes the sale and negotiation process that much easier for you.

If you could have a brand-new home for less than you may expect, would you be interested?

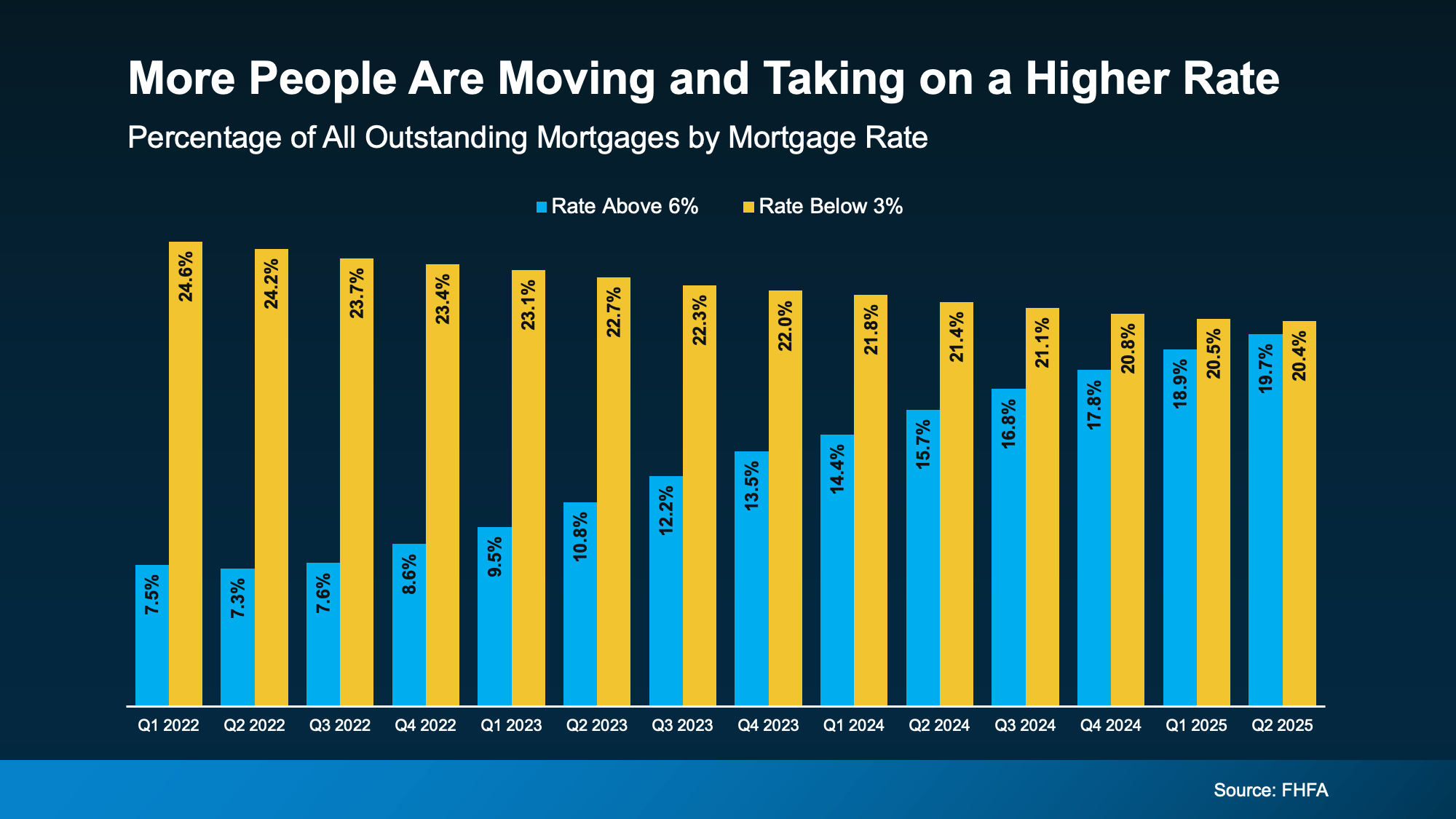

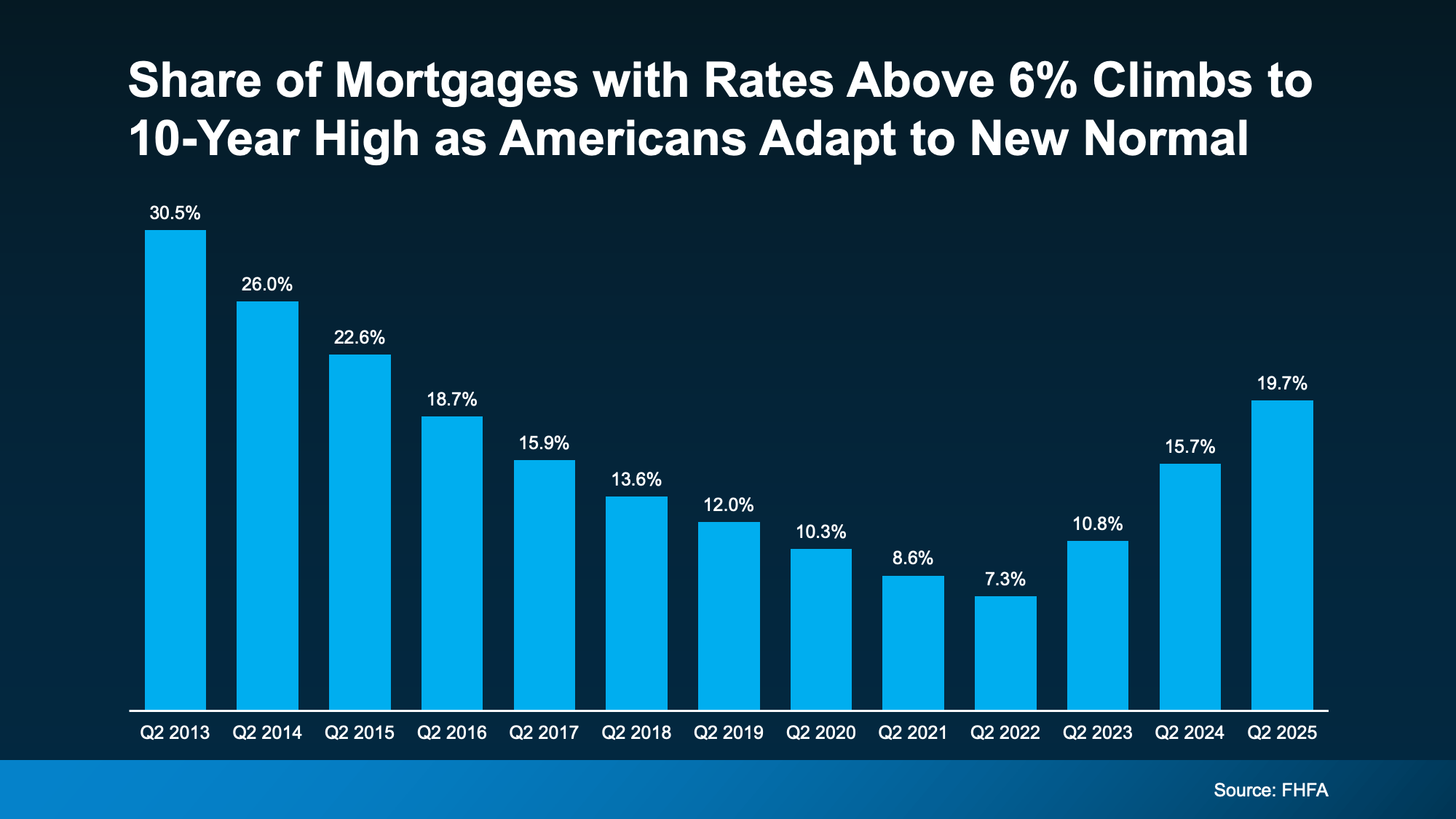

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Zillow sums it up best:

Zillow sums it up best: