Why October Is the Best Time To Buy a Home in 2025

If you’ve been watching from the sidelines, now’s the time to lean in. It’s officially the best time to buy this year. According to Realtor.com, this October will have the most buyer-friendly conditions of any month in 2025:

“By mid-October, buyers across much of the country may finally find the combination of inventory, pricing, and negotiating power they’ve been waiting for—a rare opportunity in a market that has been tight for most of the past decade.”

So, if you’re ready and able to buy right now, shooting for this month means you should see:

- More homes to choose from

- Less competition from other buyers

- More time to browse

- Better home prices

- Sellers who are more willing to negotiate

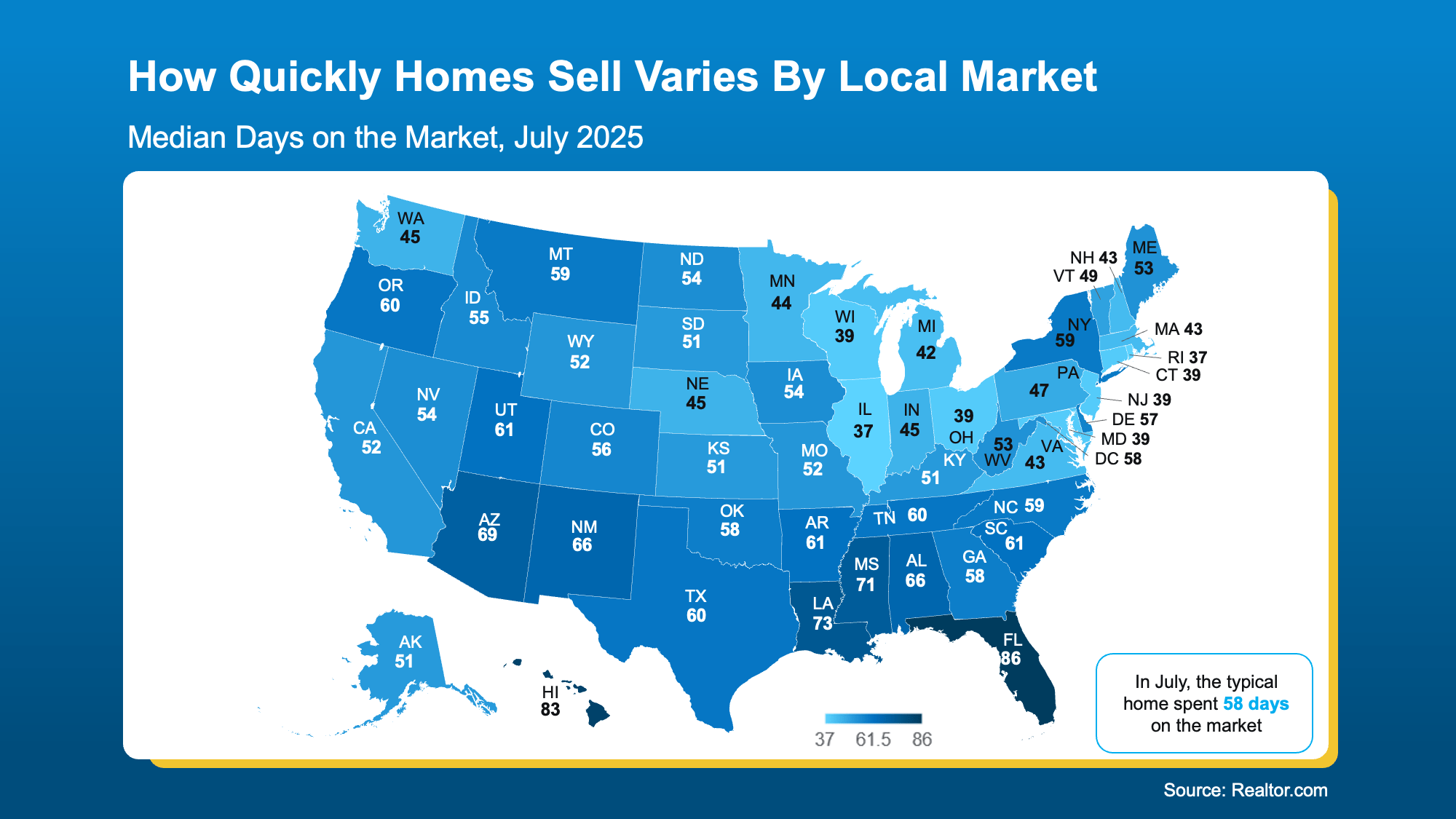

Just remember, every market is different. For most of the top 50 largest metros, that sweet spot falls in October. But the peak time to buy may be slightly earlier or later, depending on where you live. As Realtor.com explains:

“While Oct. 12–18 is the national “Best Week,” timing can shift depending on the local markets. . .”

Best Week To Buy for the Top 50 Largest Metro Areas

- Atlanta-Sandy Springs-Roswell, GA: September 28 – October 4

- Austin-Round Rock-San Marcos, TX: September 28 – October 4

- Baltimore-Columbia-Towson, MD: October 12 – 18

- Birmingham, AL: October 19 – 25

- Boston-Cambridge-Newton, MA-NH: October 26 – November 1

- Buffalo-Cheektowaga, NY: October 12 – 18

- Charlotte-Concord-Gastonia, NC-SC: November 2 – 8

- Chicago-Naperville-Elgin, IL-IN: September 28 – October 4

- Cincinnati, OH-KY-IN: October 12 – 18

- Cleveland, OH: October 12 – 18

- Columbus, OH: October 12 – 18

- Dallas-Fort Worth-Arlington, TX: September 28 – October 4

- Denver-Aurora-Centennial, CO: October 12 – 18

- Detroit-Warren-Dearborn, MI: October 12 – 18

- Grand Rapids-Wyoming-Kentwood, MI: September 28 – October 4

- Hartford-West Hartford-East Hartford, CT: September 21 – 27

- Houston-Pasadena-The Woodlands, TX: October 12 – 18

- Indianapolis-Carmel-Greenwood, IN: October 26 – November 1

- Jacksonville, FL: October 26 – November 1

- Kansas City, MO-KS: October 12 – 18

- Las Vegas-Henderson-North Las Vegas, NV: October 5 – 11

- Los Angeles-Long Beach-Anaheim, CA: October 12 – 18

- Louisville/Jefferson County, KY-IN: November 2 – 8

- Memphis, TN-MS-AR: September 21 – 27

- Miami-Fort Lauderdale-West Palm Beach, FL: November 30 – December 6

- Milwaukee-Waukesha, WI: September 7 – 13

- Minneapolis-St. Paul-Bloomington, MN-WI: October 26 – November 1

- Nashville-Davidson–Murfreesboro–Franklin, TN: October 12 – 18

- New York-Newark-Jersey City, NY-NJ: September 14 – 20

- Oklahoma City, OK: October 12 – 18

- Orlando-Kissimmee-Sanford, FL: October 26 – November 1

- Philadelphia-Camden-Wilmington, PA-NJ-DE-MD: September 7 – 13

- Phoenix-Mesa-Chandler, AZ: November 2 – 8

- Pittsburgh, PA: October 12 – 18

- Portland-Vancouver-Hillsboro, OR-WA: October 26 – November 1

- Providence-Warwick, RI-MA: October 19 – 25

- Raleigh-Cary, NC: October 12 – 18

- Richmond, VA: October 26 – November 1

- Riverside-San Bernardino-Ontario, CA: September 28 – October 4

- Sacramento-Roseville-Folsom, CA: October 12 – 18

- San Antonio-New Braunfels, TX: October 12 – 18

- San Diego-Chula Vista-Carlsbad, CA: October 12 – 18

- San Francisco-Oakland-Fremont, CA: October 12 – 18

- San Jose-Sunnyvale-Santa Clara, CA: October 19 – 25

- Seattle-Tacoma-Bellevue, WA: October 19 – 25

- St. Louis, MO-IL: October 12 – 18

- Tampa-St. Petersburg-Clearwater, FL: November 30 – December 6

- Tucson, AZ: October 12 – 18

- Virginia Beach-Chesapeake-Norfolk, VA-NC: September 21 – 27

- Washington-Arlington-Alexandria, DC-VA-MD-WV: October 12 – 18

What the Experts Are Saying

And Realtor.com isn’t the only one saying you’ve got an opportunity if you move now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Homebuyers are in the best position in more than five years to find the right home and negotiate for a better price. Current inventory is at its highest since May 2020, during the COVID lockdown.”

Daryl Fairweather, Chief Economist at Redfin, puts it like this:

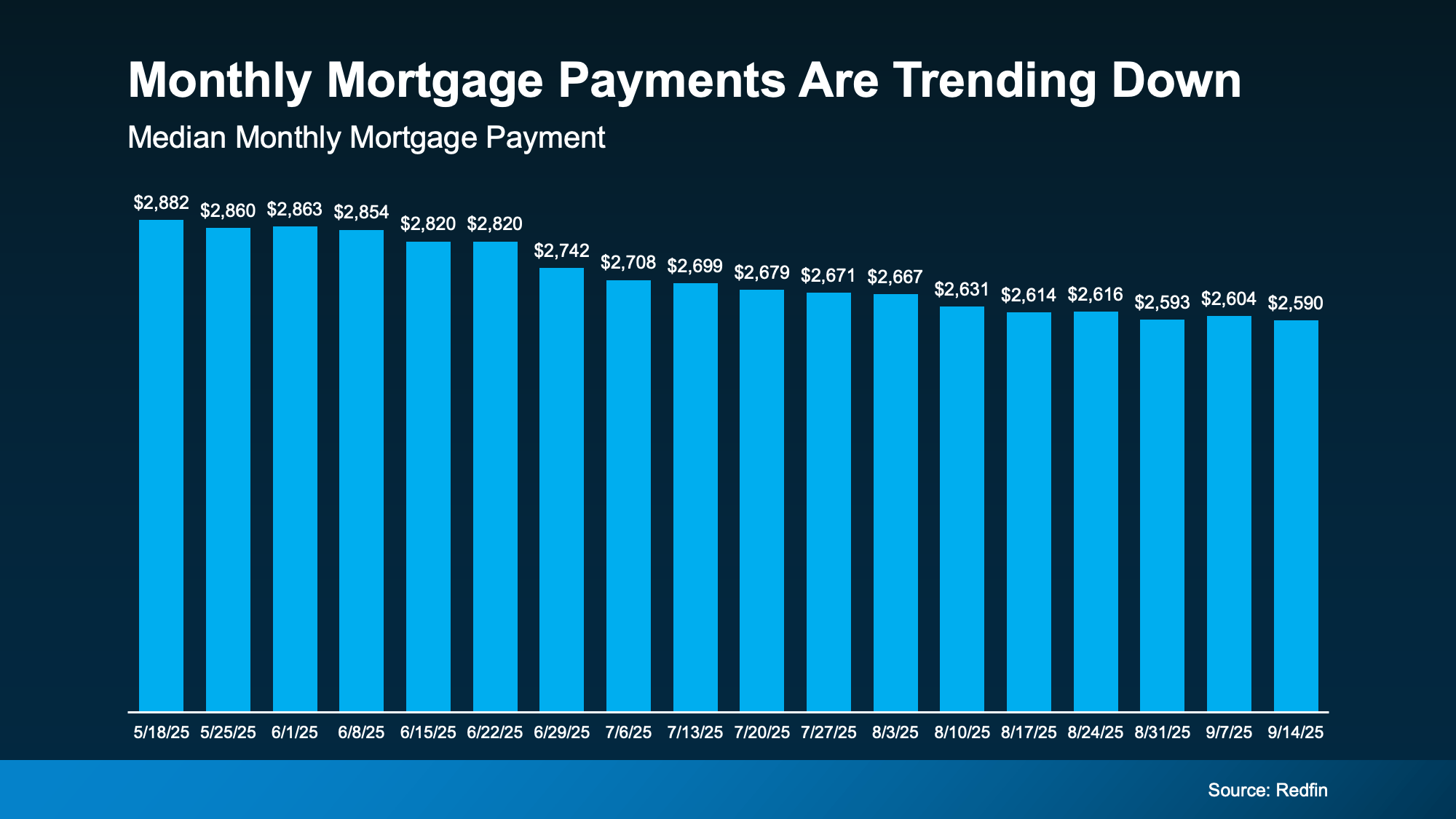

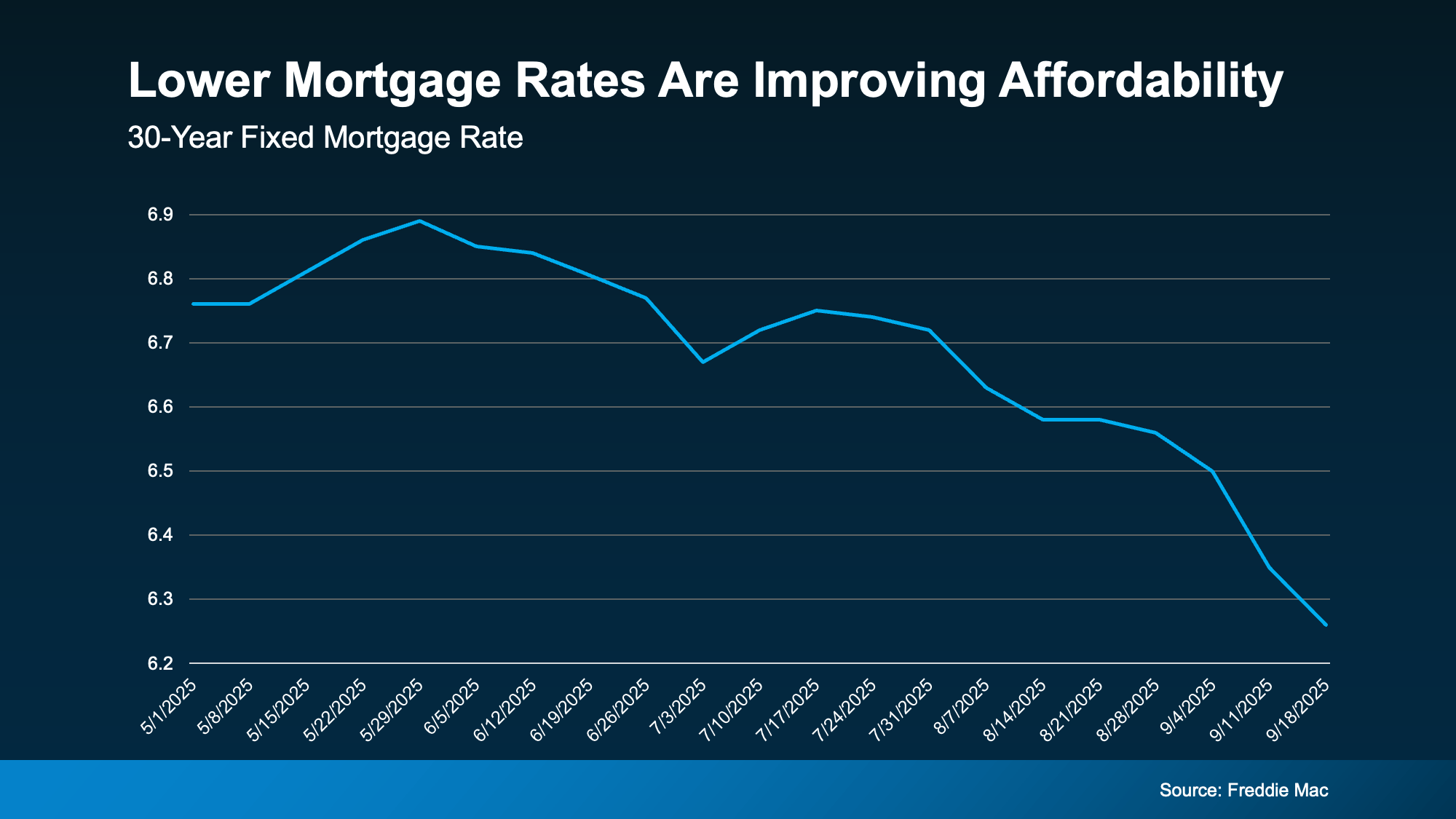

“Nationally, now is a good time to buy, if you can afford it . . . with falling mortgage rates and significantly more inventory, buyers have an upper hand in negotiations.”

And NerdWallet says:

“This fall just might be the best window for home buyers in the past five years.”

How To Get Ready for this Golden Window

To make sure you’re ready to jump in whenever your market’s best time to buy arrives, talk to a local agent now. They’ll be able to give you more information on your market’s peak time, why it’s good for you, and the steps you’ll need to take to get ready.

Bottom Line

If you’re serious about buying, getting prepped for this October window is a smart play.

Want help lining up your strategy? Have a quick conversation with a local agent so you’ve got the information you need to be ready for this prime buying time.

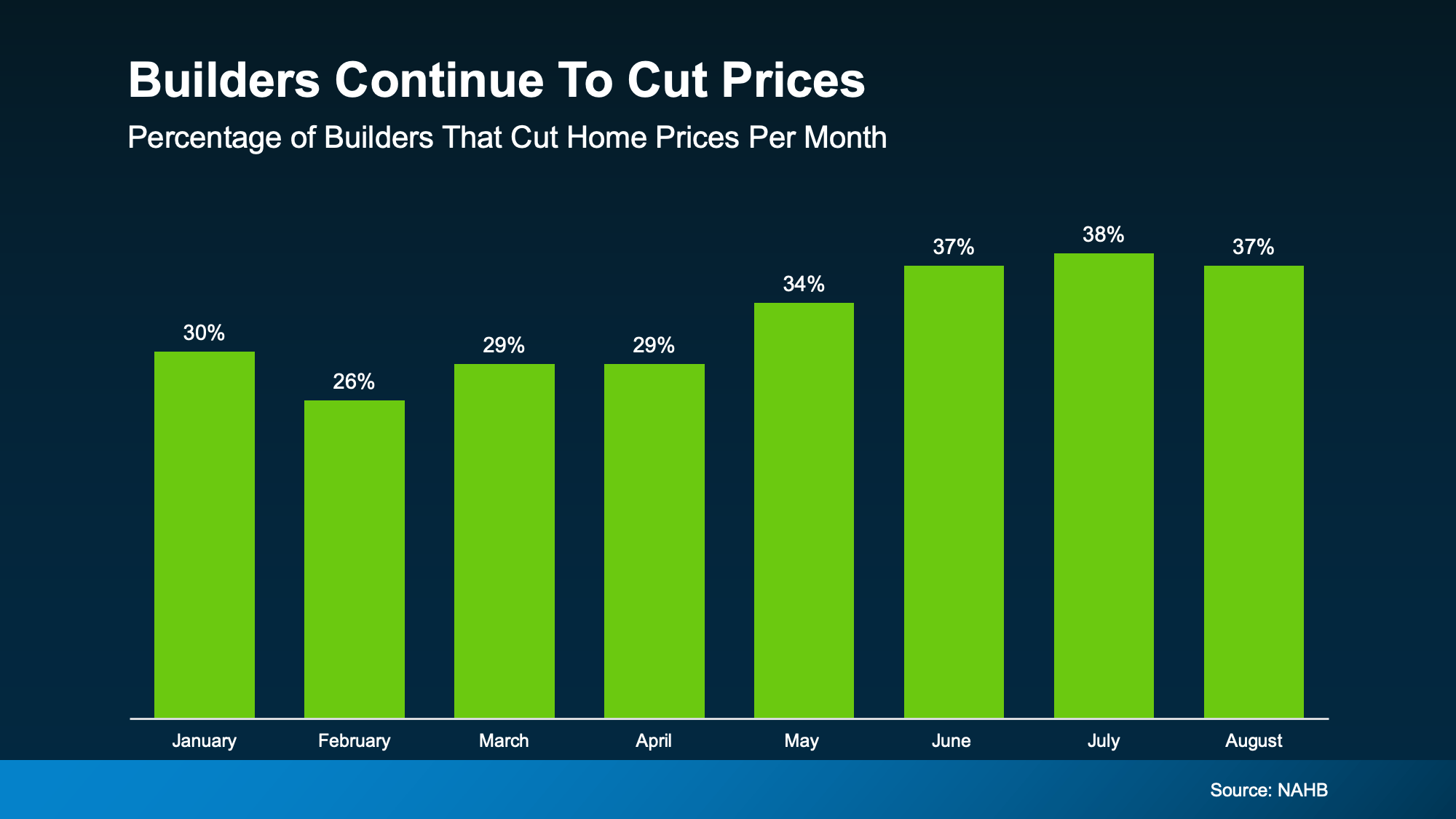

On average they’re taking off about 5% off the purchase price of the house. For a buyer, 5% could be the difference between reluctantly settling and finally getting a home that works for you.

On average they’re taking off about 5% off the purchase price of the house. For a buyer, 5% could be the difference between reluctantly settling and finally getting a home that works for you.