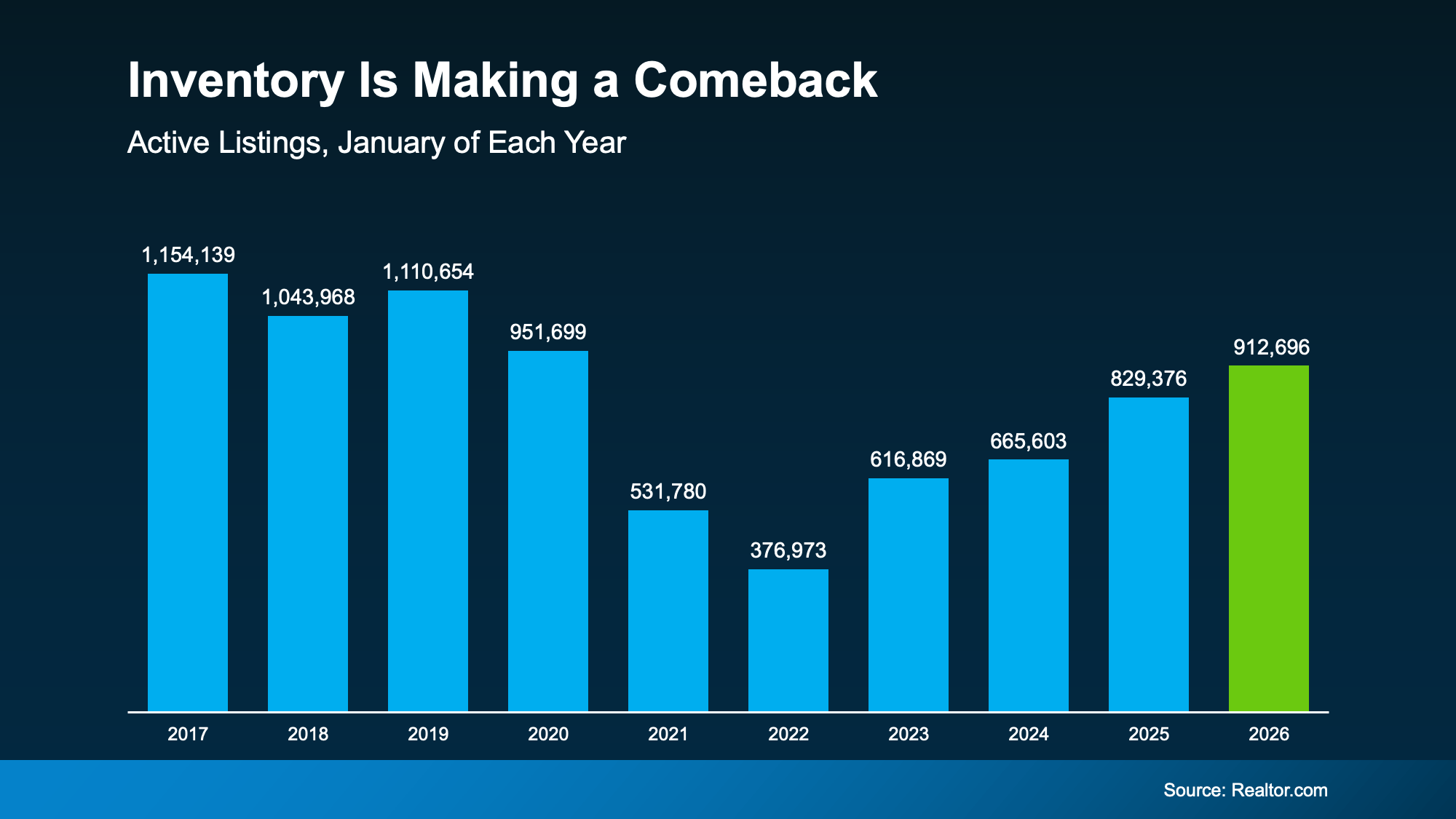

Inventory Is Making a Comeback in 2026

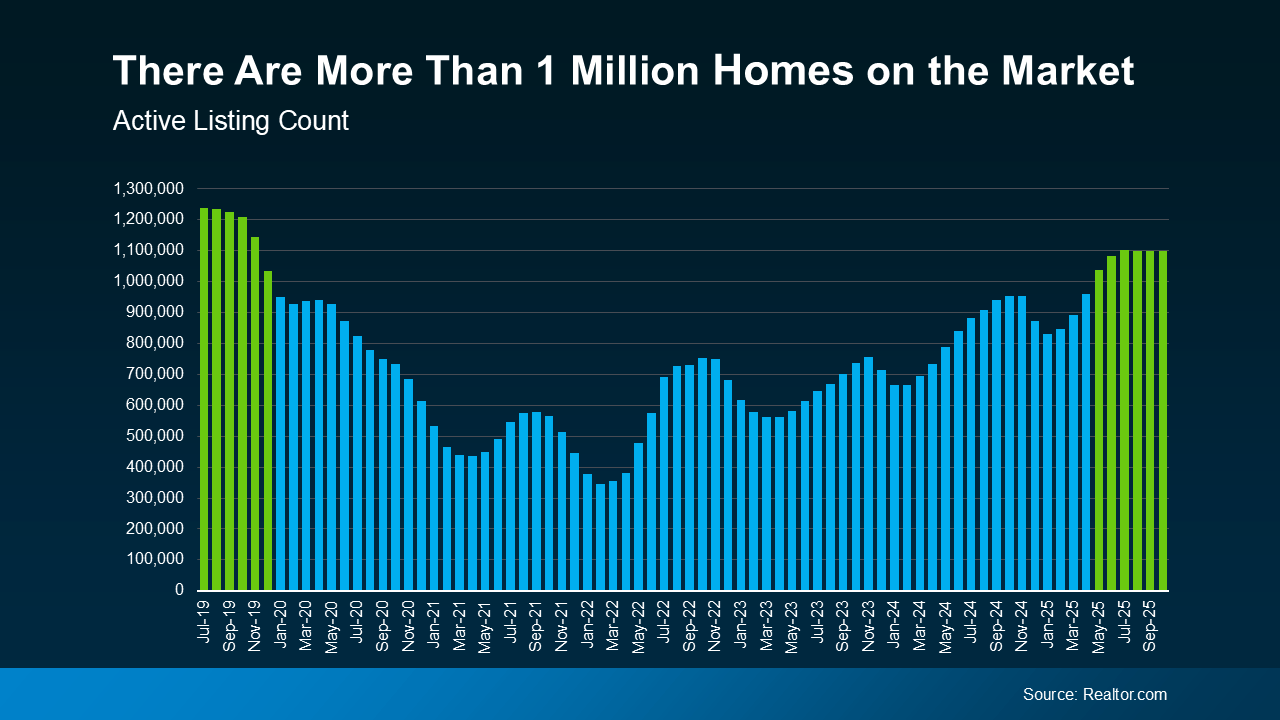

After a long stretch where buyers were competing for too few homes, inventory has made a comeback over the past year. And depending on where you live, that’s opening up your options in a meaningful way.

According to Realtor.com, the number of homes available for sale in January was the highest it’s been since 2020. Here’s why that’s such a big deal. Getting back to pre-pandemic levels signals a slow and steady return to what’s typical:

Now, it’s worth noting, nationally we’re not there yet – and having more inventory improving won’t suddenly “fix” the market. But the growth we’ve seen lately still changes how competitive the market feels.

Now, it’s worth noting, nationally we’re not there yet – and having more inventory improving won’t suddenly “fix” the market. But the growth we’ve seen lately still changes how competitive the market feels.

- When there are more homes for sale, buyers gain time, options, and leverage.

- When there aren’t, the pressure ramps up quickly.

In the years since 2020, there weren’t enough homes for sale, and that made the market feel different. Rushed. Stressful. Intimidating.

But now it’s finally getting better.

A Growing Portion of the Country Is Getting Back to Normal

Depending on where you live, inventory growth is going to vary. Some places are bouncing back faster than others. According to Lance Lambert, Co-Founder of ResiClub, in January 2025, just a little over one year ago, only 41 of the 200 largest metros were back to normal inventory-wise.

But around the end of year, almost half (90) of the largest 200 metro areas were back at or above typical levels. That’s a big improvement in roughly a year. And it’s not done yet.

Inventory Is Expected To Keep Growing

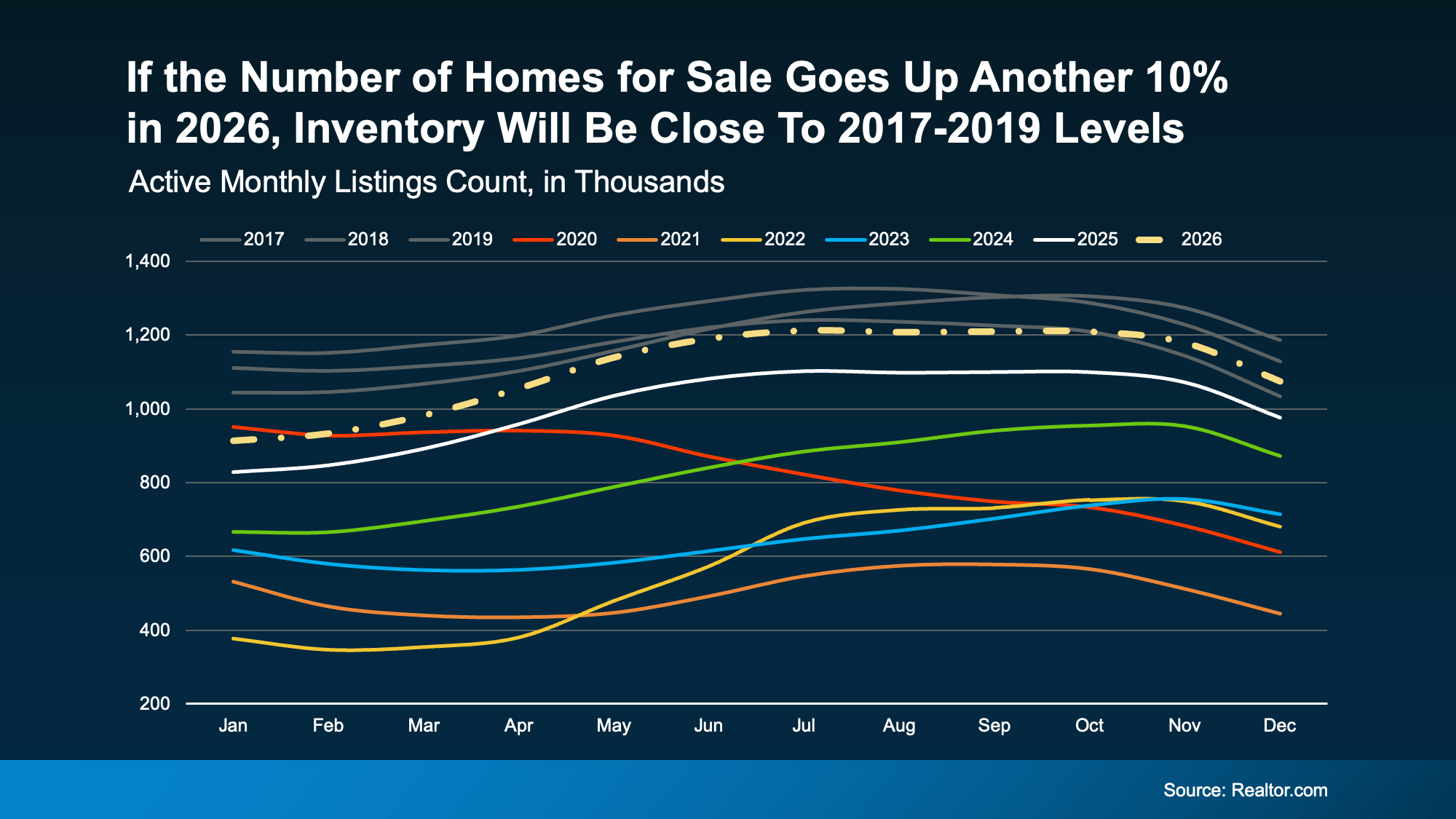

Looking ahead, forecasts suggest the number of homes for sale could rise another 10% this year, which means even more markets should join the list of places where supply has rebounded.

Here’s a graph that shows what an extra 10% would do for the market this year. You can see that projected growth (shown in the dotted line) hits inventory levels seen in 2017-2019 by roughly this fall (the gray lines). That means we may reach normal by end of year, nationally:

And that changes your home search in a good way. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, puts it:

“. . . housing market conditions are gradually rebalancing after several years of extreme seller advantage. Buyers are beginning to see more options and modest negotiating power as inventory improves . . .”

In other words, the market is starting to work with buyers again — not against them.

Bottom Line

Inventory isn’t fully back to normal everywhere. But it’s moving in the right direction. And, in some areas, it’s already there.

If you’ve been waiting for a moment when you have options and a little breathing room, this is the strongest setup buyers have seen in a long time.

If you want to know what’s happening in your local market, talk to an agent.