Why More Sellers Are Choosing To Move, Even with Today’s Rates

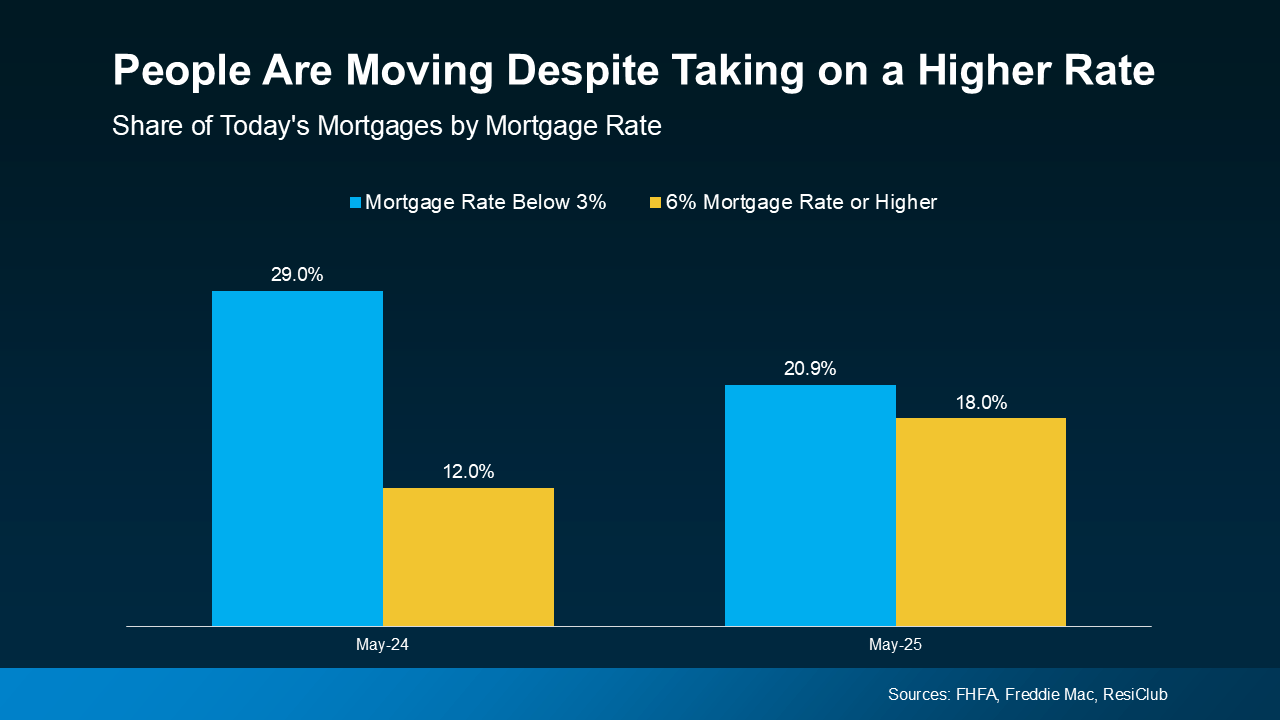

It’s hard to let go of a 3% mortgage rate. There’s no question about it. It’s the main reason why so many homeowners have delayed their move in recent years. But here’s something to consider.

While your low rate might be ideal, it doesn’t make up being too cramped, having a staircase your knees can’t handle anymore, or being 1,000 miles from your family. And those real-life needs are pushing more sellers off the fence despite today’s rates.

Data shows the share of homeowners with a mortgage rate below 3% is dropping as more people move. And, as a result, the share of homeowners taking on a mortgage rate above 6% is rising, too (see graph below):

The Biggest Reasons People Are Moving Right Now

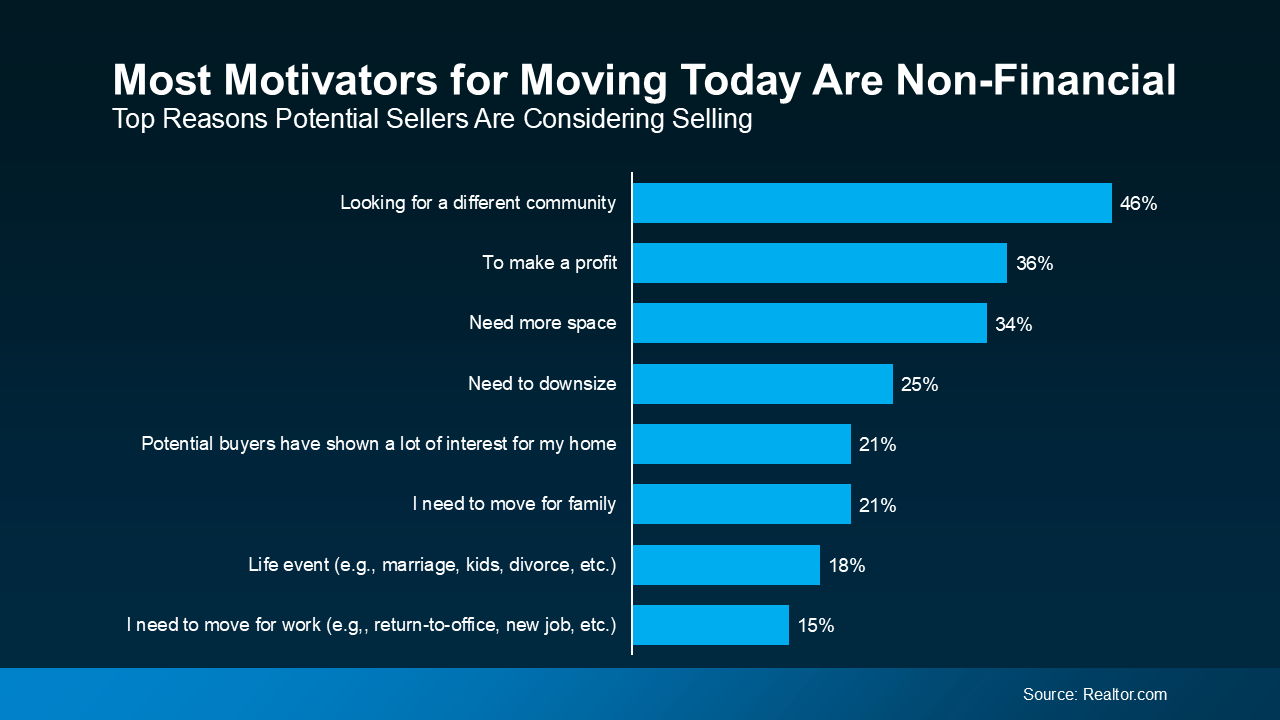

Why are some homeowners willing to take on a higher rate? A survey from Realtor.com helps shed light on that. It shows 79% of homeowners considering selling today are doing it out of necessity. And that same survey says most of the necessary reasons people are moving are non-financial in nature (see graph below):

Do any of these reasons resonate for you, too?

Do any of these reasons resonate for you, too?

- You Need More Space: Whether it’s a new baby, children needing their own rooms, or having your parents move in so it’s easier to take care of them, outgrowing your space can happen fast.

- You Need Less Space: The kids are out of the house now and you’re craving a life that’s a little simpler. Downsizing can be a major relief: fewer rooms to clean, less to maintain, and lower utility bills, too.

- You Want to Be Closer to Family: Whether it’s to help with grandchildren or care for aging parents, sometimes the pull of being near loved ones outweighs the math.

- A Relationship in Your Life Has Changed: Divorce, separation, or moving in together after a marriage or new partnership – all can create the need for a fresh start and a new place to call home.

- Your Job Is Taking You Somewhere New: If you finally landed your dream job or your partner’s company is relocating, you may need to move too.

What About Mortgage Rates?

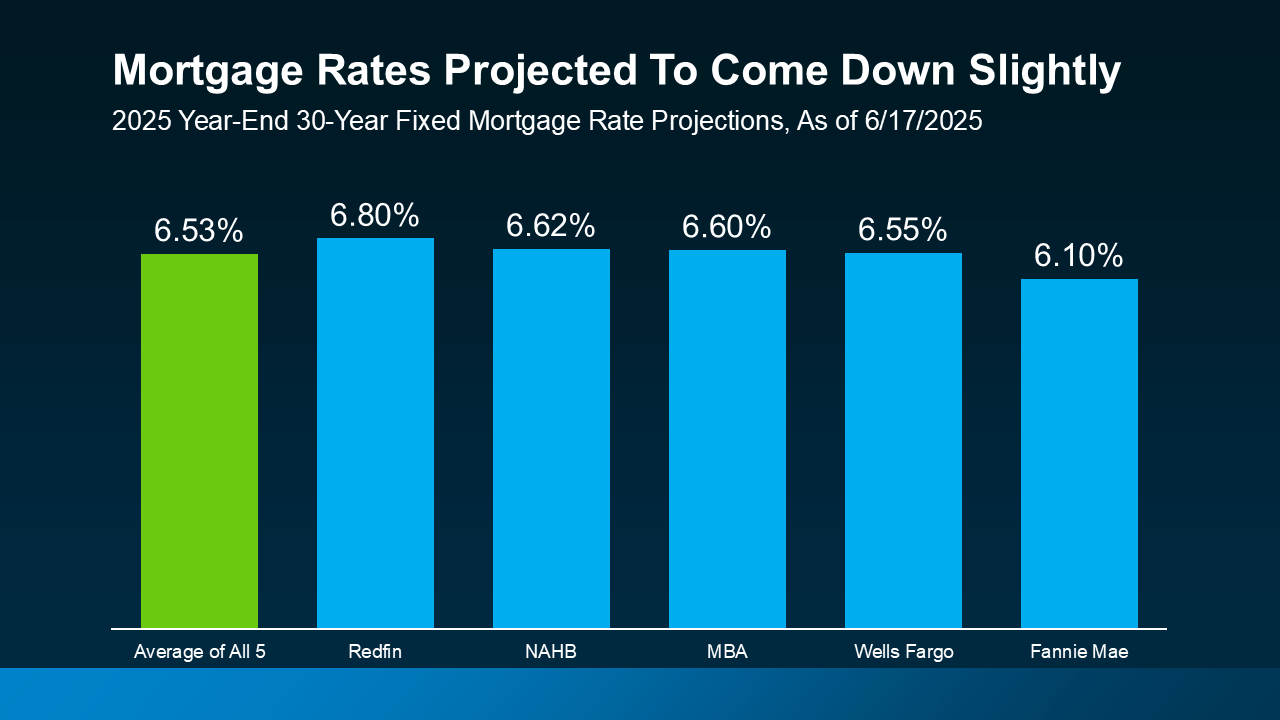

Yes, experts expect mortgage rates to ease, but slowly. The latest projections show only modest declines this year – not the 3% you may be hoping for (see graph below):

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

According to Realtor.com, nearly 2 in 3 potential sellers have been thinking about moving for over a year. If you’re one of them, maybe it’s time to ask:

How much longer are you willing to press pause on your life?

Bottom Line

Maybe your current house fit your life five years ago. But that “for now” house you bought in 2020? It just can’t deliver on what you need in 2025. And that’s not just okay, it’s normal.

Mortgage rates are part of the equation, for sure. But the bigger question is:

What kind of home do you need to support the life you’re living now?

Talk to an agent about what’s changed, and what kind of move would actually take your life forward.

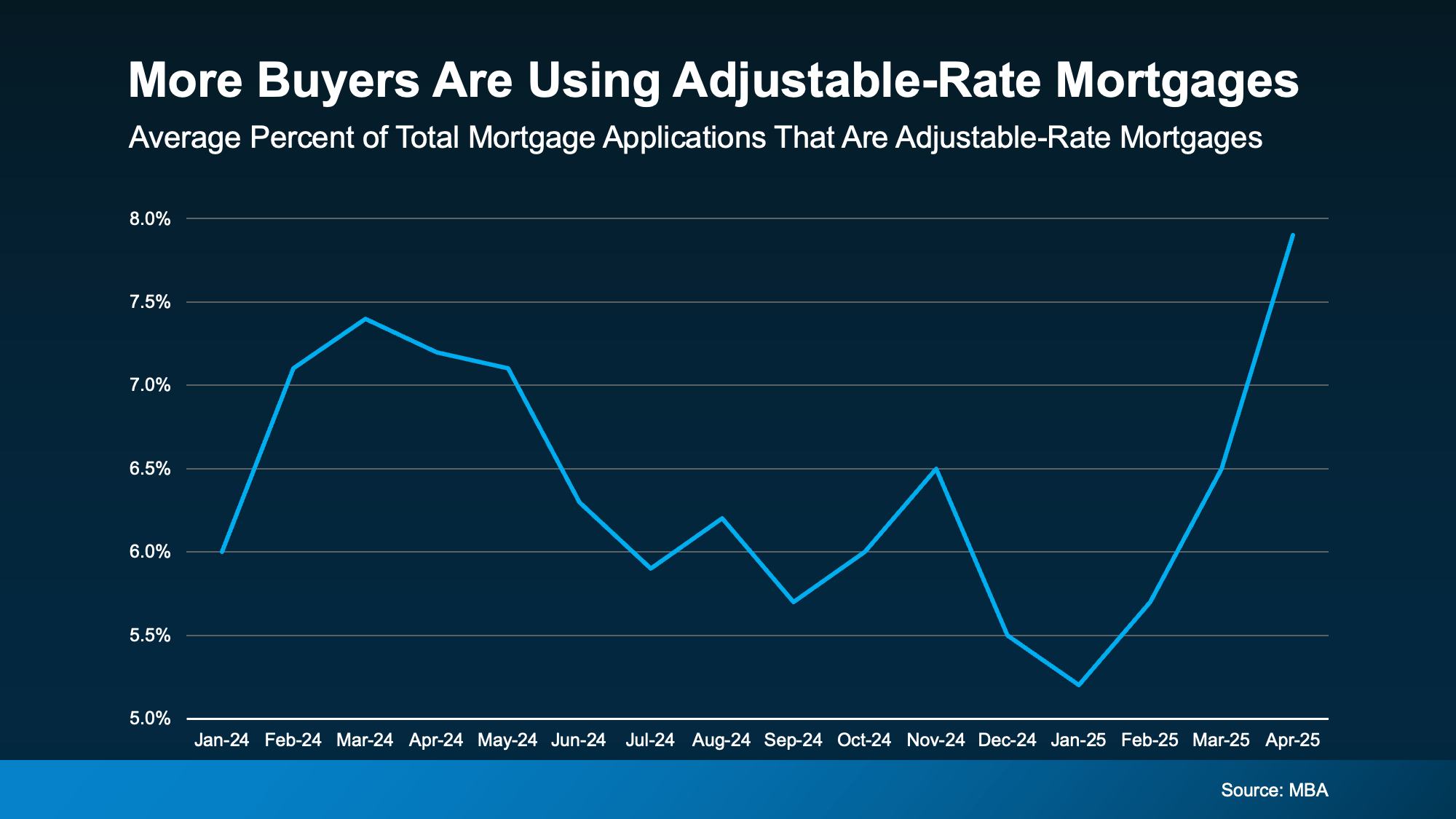

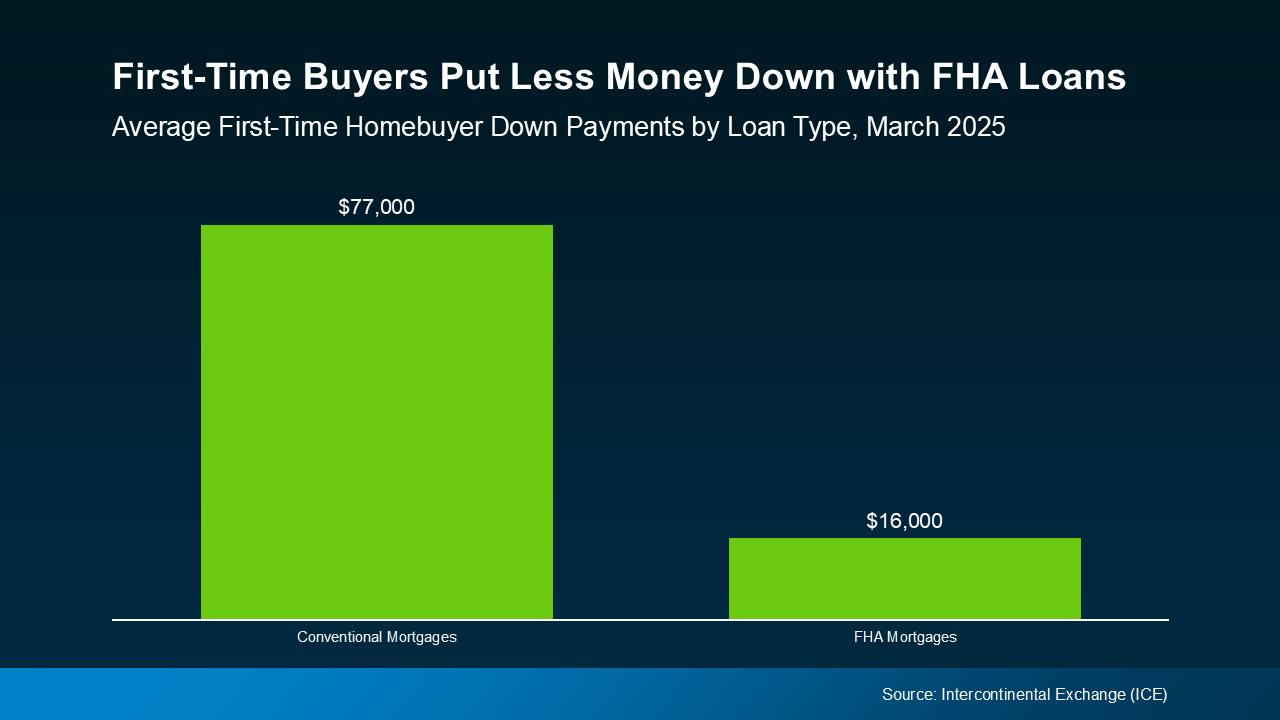

That’s Where FHA Loans Come In

That’s Where FHA Loans Come In Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.